The Simple, Secure, and Easiest Way to File Your Taxes.

Get your income tax return filed quickly and accurately Through Whatsapp. Our team ensures your return is error-free and maximizes your tax savings, all while providing expert assistance from certified CAs.

The Most Simplified Tax Filing Process for Individuals Through Whatsapp.

+91 81306 45164

support@legalsuvidha.com

Get Tax Planning Consultation.

Just drop a message on our WhatsApp and start your tax filing process, once the process starts, Our tax Filing Expert will get in touch with you to clarify your queries and collect more details if required & helps in maximize your Tax Deductions.

How Your Filing Process Will Go?

Connect with Our WhatsApp Bot

Start by connecting with our WhatsApp bot. Provide your name, email, and phone number. Answer simple Q&A to submit your details and securely upload your documents through the bot.

Document Review and Consultation

Your dedicated eCA reviews your documents for accuracy and completeness. The eCA schedules a call to discuss your income, investments, and deductions to maximize your refund.

Sit Back and Let Us Handle Everything

We handle maximizing deductions and savings on your taxes. Our team verifies Form 26AS with the department to ensure you receive the maximum benefit from your TDS.

Review and Finalize Your ITR Filing

Receive a thorough summary of your Income Tax Return for your review and approval. Once you've signed off, your return can be submitted directly through your dashboard.

Are you a Individual?

Trust us to handle your taxes with precision and speed, so you can enjoy peace of mind and get back to what matters most. Let us take care of your tax filing needs in no time!

- Salaried Employees

- Rental Income Earners

- Senior Citizens

- Self Employed

- Investors

- Income From Agriculture

Our personalized tax services cater to salaried employees, individuals with rental income, and senior citizens with interest income. We aim to minimize your tax burden while maximizing your savings.

Google Ratings

Unsure Which Tax Return to File?

ITR-1 is for resident individuals with a total income of up to INR 50 lakhs. It applies to:

- Income from salary or pension.

- Income from a single house property (not including cases where losses need to be carried forward).

- Income from agriculture up to INR 5,000.

- Income from other sources (excluding winnings from lotteries and race horses).

ITR-2 is for individuals or Hindu Undivided Families (HUF) with various sources of income such as:

- Income from salary or pension.

Income from house property. - Income from capital gains.

Income from other sources, including lottery winnings and income from racehorses. - Income from agriculture exceeding Rs. 5,000.

- Holding foreign assets or earning foreign income.

- Additionally, if you are a company director or have investments in unlisted equity shares at any time during the financial year, you must file ITR-2.

This form is not for individuals with income from business or profession.

ITR-3 is for individuals and Hindu Undivided Families (HUF) with income from business or profession (PGBP). It can also include:

- Income from salary or pension.

- Income from house property.

- Income from capital gains.

- Income from other sources, such as winnings from lottery and income from racehorses.

ITR-6 is designed for companies, except for those claiming exemption under Section 11 (income from property held for charitable or religious purposes).

ITR-7 is available for individuals, including companies, who are required to file returns under the following sections:

- Section 139(4A): Trusts with income.

- Section 139(4B): Political parties.

- Section 139(4C): Entities engaged in scientific research.

- Section 139(4D): Universities and colleges.

“Experience secure and hassle-free tax payments with TaxRefundWala’s WhatsApp bot. Simplifying tax filing and payments for your peace of mind.”

CA Mayank Wadhera

CEO & Founder

Necessary Documents for Filing Income Taxes

PAN Card

Permanent Account Number, essential for tax identification and filing purposes.

AADHAR Card

Aadhaar serves as a proof of identity and address, often required for verification.

Bank Statements

Provides a summary of your financial transactions, crucial for income and expenditure verification.

Form 16

Provided by employers, summarizes salary income, TDS deducted, and other details for the financial year.

Form 26AS

Consolidated tax statement that includes details of taxes deducted and deposited on your behalf.

Form 16A/16B

Certificates for TDS deductions on payments other than salaries, like rent, interest, or professional fees.

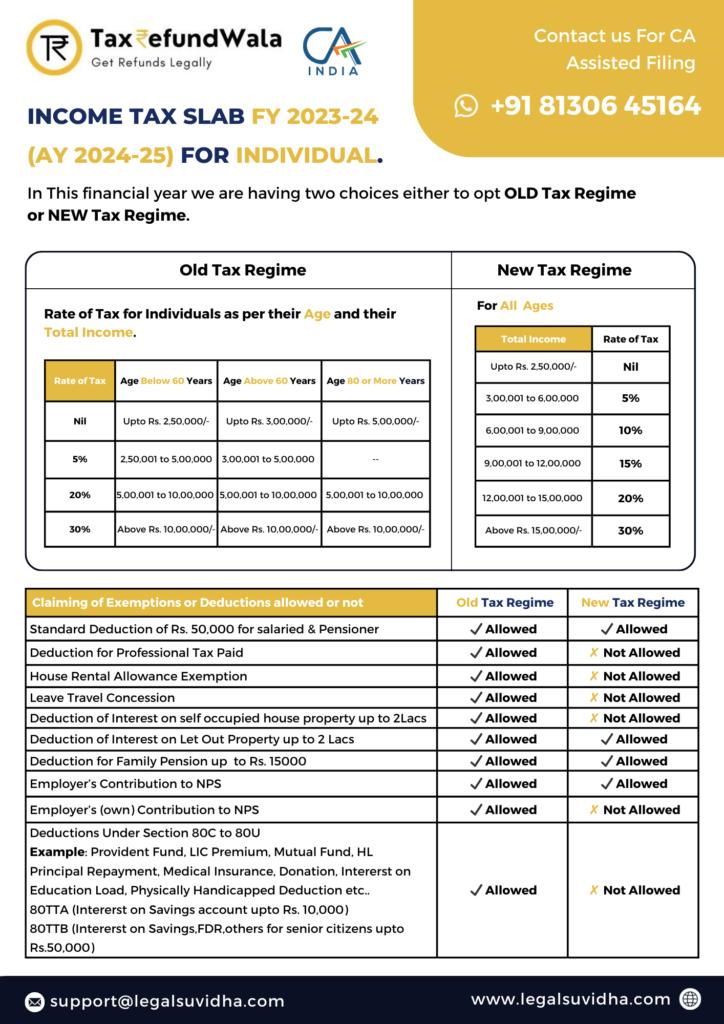

Old vs New Tax Regime

Understanding the tax structures can help you optimize your tax filing experience. The traditional regime offers numerous deductions and exemptions, which can significantly reduce your taxable income.

Old Tax Regime

More Deductions and Exemptions: The old tax regime allows for various deductions and exemptions, such as those for investments under Section 80C, medical insurance premiums under Section 80D, and house rent allowance (HRA), which can significantly reduce your taxable income.

New Tax Regime

Simplified Tax Slabs with Lower Rates: The new tax regime offers simplified tax slabs with lower tax rates but does not provide the majority of deductions and exemptions available under the old regime. This can be beneficial for taxpayers with fewer investments and deductions.

Our Customer Feedback

I was worried about filing my taxes on time, but TaxRefundWala's seamless process and expert assistance made it a breeze. Their WhatsApp bot is incredibly convenient!

Get Started with Your Income Tax Filing Today!

Experience the easiest way to file your Income Tax Return with Legalsuvidha. Get your tax return filed quickly and accurately & Certified CAs are here to maximize your tax savings.

Frequently Asked Questions

If your financial situation involves complex income sources, investments, or deductions, consulting with a CA can help ensure accurate filing and maximize potential refunds. Legalsuvidha's experts can assist you with seamless and precise ITR filing.

Expert CA assistance ensures accurate and reliable tax filings, compliance with tax laws, error minimization, tax optimization, audit support, and peace of mind. Their guidance saves you time and offers tailored solutions.

Yes, Legalsuvidha offers eCA-assisted services for various types of income, including capital gains, foreign income, NRI income, multiple Form 16s, business income, and more.

Yes, your information's security and confidentiality are a top priority when using the eCA-assisted option on Legalsuvidha.

Legalsuvidha provides easy and accessible online tax filing, professional CA expertise, precision and error-free filing, deadline adherence, secure document handling, updated tax information, and ongoing support.

Legalsuvidha's tax experts identify the reasons for the Defective Return Notice and help revise your ITR accordingly.

Legalsuvidha offers CA assistance at a competitive and affordable price, making it accessible for all.

When filing an Income Tax Return, a tax expert may need the following documents:

Personal Details:

PAN (Permanent Account Number)

Aadhaar Card

Contact details (address, phone number)

Bank account information.

Income Documents:

Form 16 for salaried individuals

Bank account statements

Interest certificates from banks or post offices

Details of rental income

Information on income from investments, freelancing, or other sources

Investment Records:

Investment documents like receipts, certificates, or statements (e.g., ELSS, PPF, NSC, etc.)

Proof of insurance premium payments

Home loan certificates, if applicable

Deductions and Exemptions:

Receipts and proofs for deductions under

Sections 80C to 80U (e.g., LIC premiums, tuition fees, etc.)

Medical bills and health insurance premium receipts

Donation receipts for deductions under Section 80G

Property Information:

Property ownership records for calculating income from house property (e.g., rental income, home loan interest)

Capital Gains:

Details of capital gains from the sale of property, stocks, mutual funds, and other investments

Business/Professional Information (if applicable):

Profit and loss statements

Balance sheets

Proof of business expenses

Other Relevant Documents:

Any other receipts or documents related to income or deductions that apply to your specific situation